The excitement around the potential approval of a spot Bitcoin ETF (exchange-traded fund) is reaching a fever pitch. Bloomberg analysts Eric Balchunas and James Seyffart have weighed in, bringing their expertise to the fore.

Balchunas has reduced the likelihood of the US Securities and Exchange Commission (SEC) denying the ETF to a mere 5%. Still, SEC Chair Gary Gensler advised investors not to FOMO.

SEC Won’t Deny Spot Bitcoin ETFs

Seyffart elaborated on the possible scenarios if his 90% certainty about the approval of a spot Bitcoin ETF does not pan out. These include ARK withdrawing its application with assurances for March or an unexpected move from Gensler leading to a denial. Seyffart also pointed out an extreme situation that includes an intervention from the Biden administration.

Balchunas concurred, emphasizing the slim probability but acknowledging the necessity to consider all possibilities.

Hedge fund manager James Lavish remarked on the difficulty of assigning precise probabilities to such events. Especially given their potential to drive significant outcomes for Bitcoin’s value.

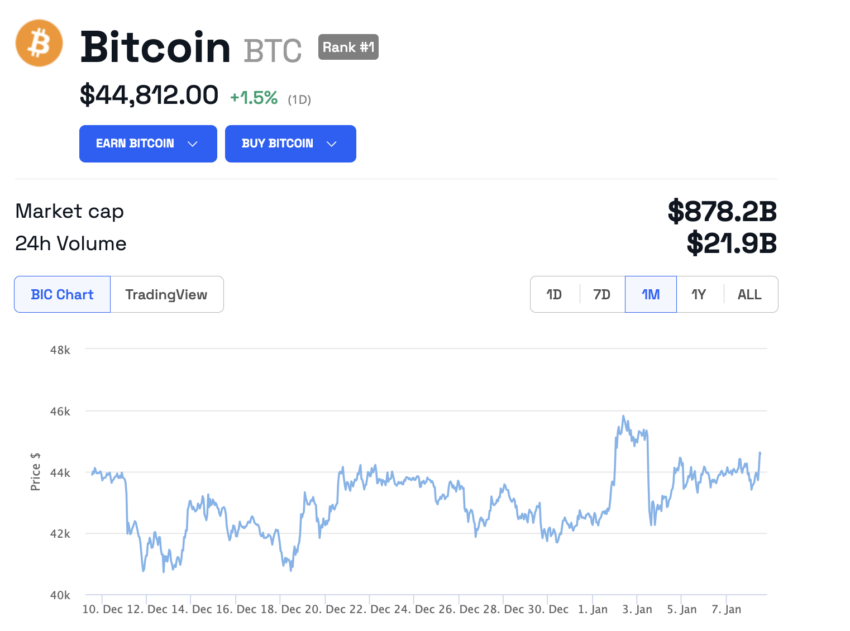

As the community anticipates approval of a spot Bitcoin ETF anytime soon, the price of BTC is trading at nearly $45,000.

Fear of Missing Out Heightens

Amidst this speculative atmosphere, the SEC has a stark warning against the dangers of FOMO (Fear of Missing Out). In a detailed statement, the SEC urged investors to exercise caution and restraint, particularly in trending investment opportunities like cryptocurrencies, meme stocks, and NFTs (Non-Fungible Tokens)

“Fraudsters continue to exploit the rising popularity of crypto assets to lure retail investors into . These investments continue to be replete with/ fraud, bogus coin offerings, Ponzi and pyramid schemes, and outright theft where a project promoter disappears with/ investors’ money,” SEC Chair Gary Gensler

Highlighting the volatility and unpredictability of these markets, the SEC advised to avoid making investment decisions based purely on trend-following or influencer endorsements

The SEC stressed the importance of a diversified investment portfolio encompassing a mix of stocks, bonds, and cash. According to the SEC, this approach is crucial in managing risk and mitigating the impact of market volatility. Investors were reminded to focus on long-term financial planning, emphasizing strategies like paying off high-interest debt and harnessing the power of compound interest.